New study looks at increasing the success and effectiveness of mangrove conservation investments

Research offers guidance on making mangrove conservation investments more sustainable and impactful

Mangroves are under threat globally due to land conversion, overexploitation, and other human-induced stressors. Various stakeholders, including governments and NGOs, have been working on the conservation and restoration of mangrove ecosystems for years, yet with mixed results. Lack of sustainable finance, beyond an initial project implementation cycle, is often cited as a reason for long-term project failure.

A new report by the Save Our Mangroves Now! initiative, co-led by WWF-Germany and IUCN and supported by BMZ, provides guidance on making mangrove conservation investments more sustainable and impactful. As part of the study, the authors looked at the common successes and challenges linked to mangrove conservation and the business case for private sector to engage in conservation efforts

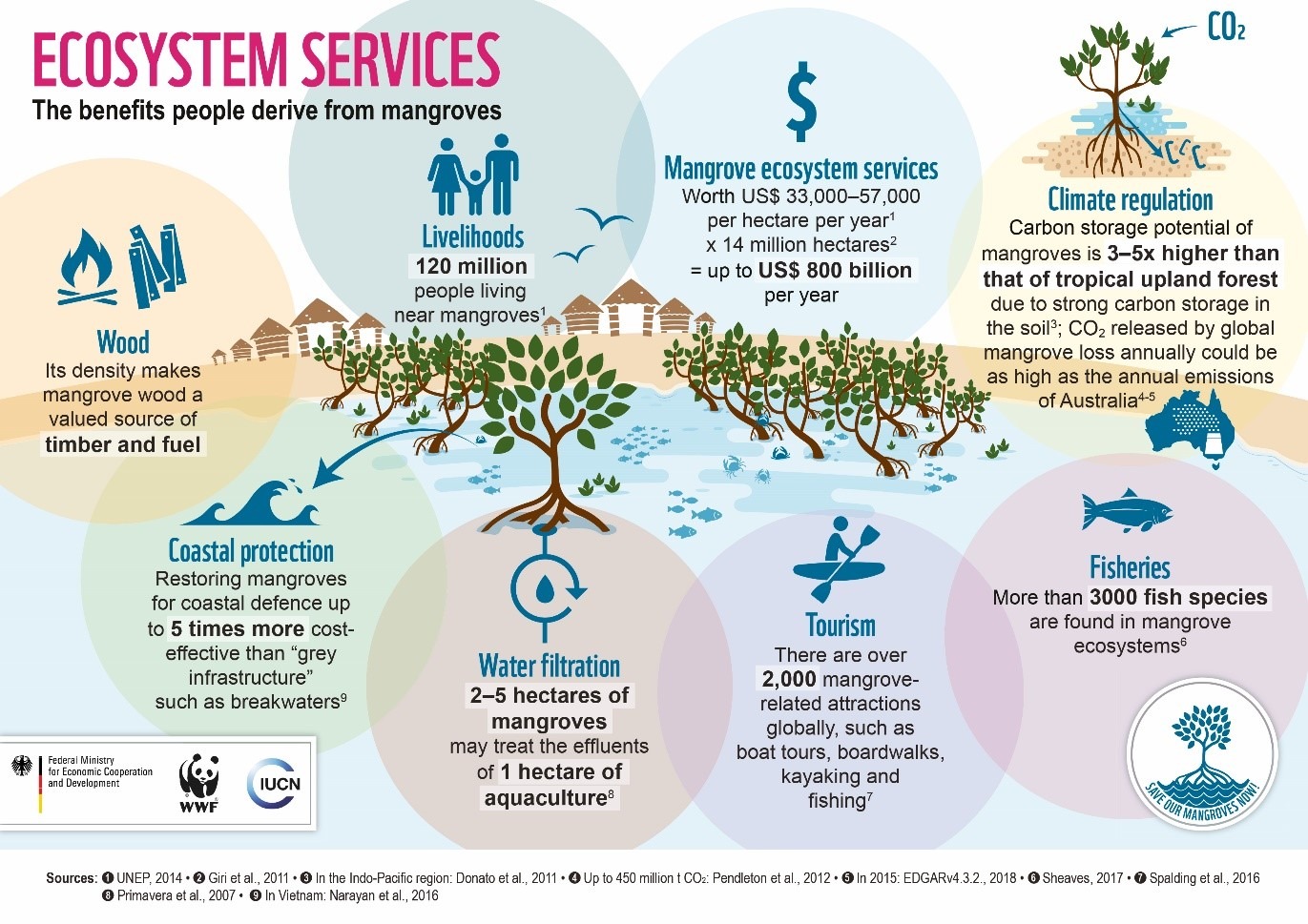

Mangroves provide valuable ecosystem services estimated to be worth thousands to tens of thousands of USD per hectare, and play an important role in climate change mitigation and adaptation.

Investing in mangroves can deliver a number of environmental and social benefits. This is of great interest to governments wanting to reduce coastal damage and impact investors wanting to ‘do good’ while earning economic returns.

Many of the benefits of mangroves are in cost-avoidance, while others can provide financial revenues, such as activities related to fisheries, the carbon market or tourism. Additionally, conservation of these ecosystems has also been shown to contribute to the UN Sustainable Development Goals (SDGs) and other national and international environmental targets and commitments by sequestering green house gases as “blue carbon”. This can help fulfill the commitments to targets set by Convention on Biological Diversity Aichi targets and UNFCCC Paris Agreement.

Using case studies from on-going projects in Kenya (Mikoko Pamoja), Madagascar (Manambolo-Tsiribihina) and Viet Nam (Mangroves and Markets I), some common successes and challenging factors were identified to provide recommendations for future investments.

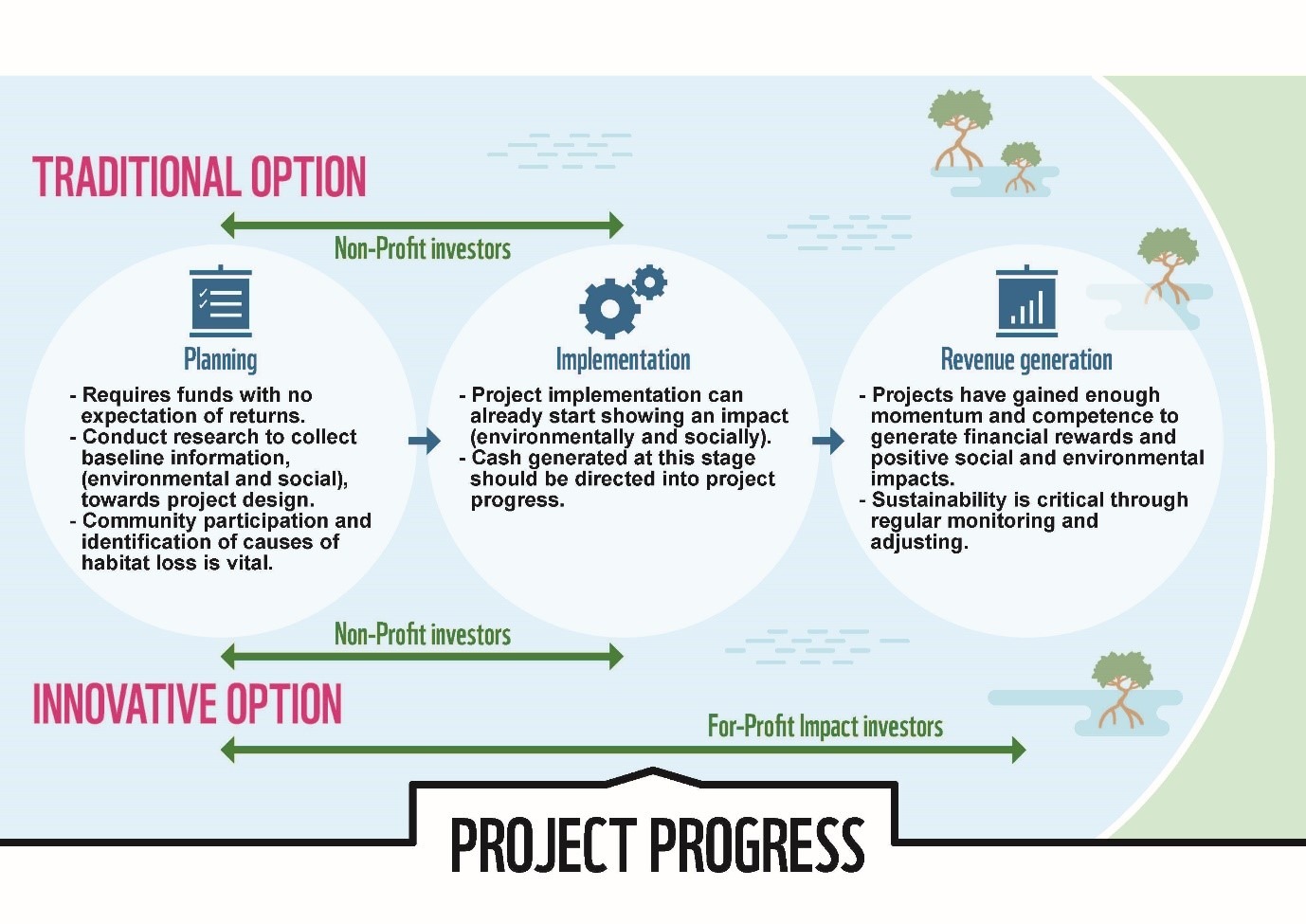

For current and future projects, this will mean investing effort in the project planning stages and embracing a longer timeframe to take advantage of the diverse benefits effective mangrove conservation can provide. To sustain mangrove management from a financial point of view, an increasingly promising and innovative option are emerging collaborations between non-profit and impact investors using approaches such as blended finance.

In the future, new finance mechanisms and approaches, alongside new partnerships, have to be set up and strengthened to provide proof of concept. Global standards for mangrove conservation have to be improved, implemented and better monitored in the field.

The study and full report is available online alongside a sister publication on the legal and institutional frameworks governing mangroves, and a summary brochure.